The waste and recycling trade noticed a spread of developments and investments in 2024.

Extra individuals entered the workforce this 12 months, and newly proposed security protections and rules on PFAS may have an effect on operations transferring into 2025. In the meantime, corporations continued to spend money on notable M&A transactions and recycling infrastructure enhancements.

The trade additionally noticed an inflow of federal funding for recycling and composting initiatives. Business-backed federal payments have been gradual to maneuver ahead, although states had higher luck passing influential laws.

We’ve gathered a few of the trade’s highlights by the numbers to assist put 2024 in perspective. What themes will you be watching in 2025? Tell us at waste.dive.editors@industrydive.com.

Labor and the financial system

Justin Sullivan by way of Getty Photos

By the numbers

The estimated variety of employees employed in “waste administration and remediation companies” in November 2024, in response to seasonally adjusted BLS knowledge. That quantity is up 20,000 from November 2023.

The rating for refuse and recyclable materials collectors on the deadliest jobs record, in response to Bureau of Labor Statistics knowledge launched in December 2024.

M&A

Brandon Bell by way of Getty Photos

By the numbers

The variety of transactions involving strong waste and environmental companies corporations, within the U.S. and Canada, tracked by Waste Dive to this point in 2024.

The worth of WM’s buy of Stericycle, which closed in November and was the sector’s largest deal of 2024.

The utmost variety of industrial waste zones one firm can function in as a part of New York’s nonexclusive franchise system. Waste Connections bumped in opposition to that threshold with its buy of Royal Waste Companies, triggering ripple results. It was the native market’s largest acquisition in years.

Federal coverage

Picture illustration by Brian Tucker/Waste Dive

By the numbers

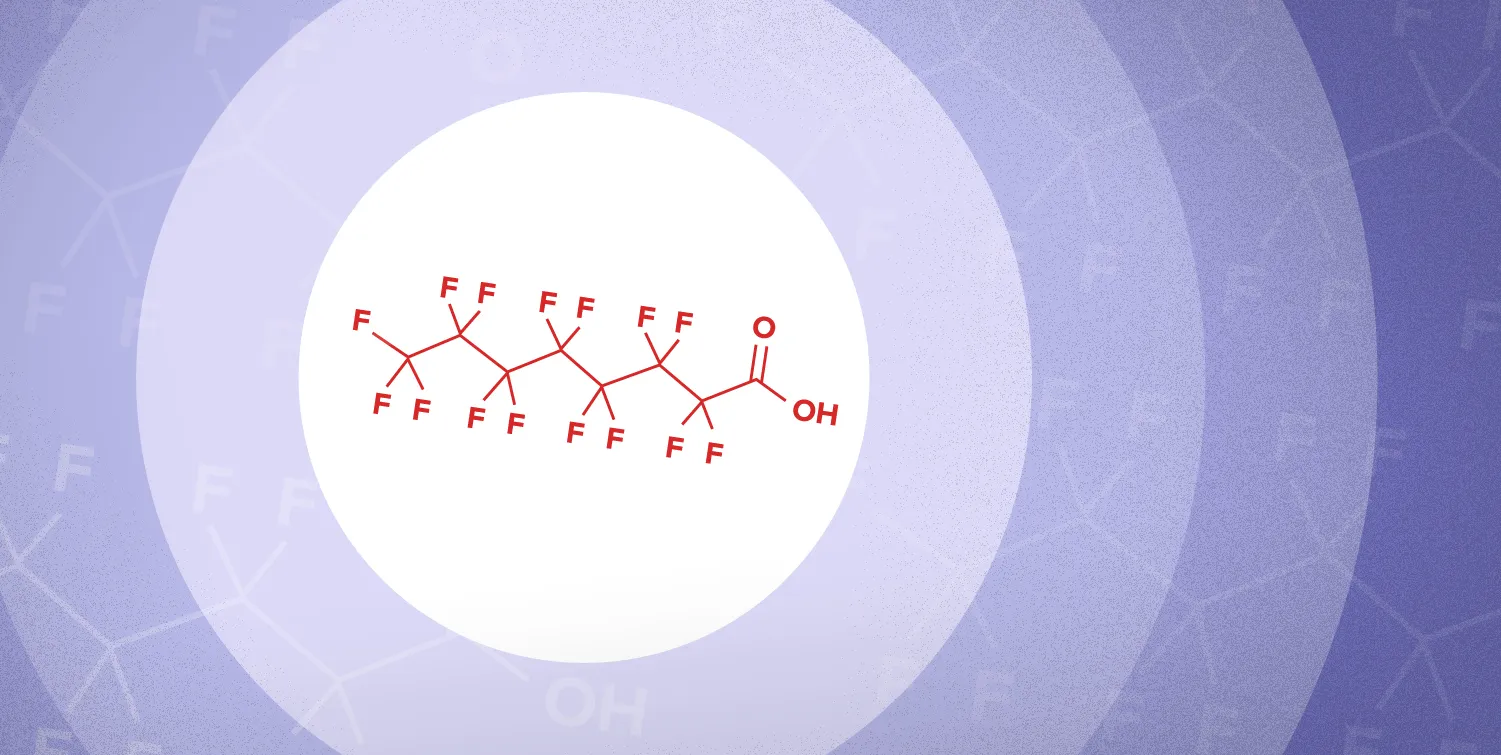

The utmost contaminant stage for PFOA and PFOS in consuming water set by the U.S. EPA in April. The restrict may have an effect on landfill operators and different waste entities as a result of groundwater, leachate and clean-up requirements.

100+

The mixed whole in grant funding that the U.S. Division of Power issued to American Battery Know-how Co., Cirba Options and Clarios Round Options. The grant program is one in every of many in recent times aimed toward boosting recycling capability, together with for lithium-ion batteries.

State and native

Megan Quinn/Waste Dive

By the numbers

5

Recycling tendencies

Courtesy of Rumpke Recycling

By the numbers

$66

The typical worth per ton for OCC in December, down 16% 12 months over 12 months and 11% from the earlier month, in response to Jefferies. OCC costs elevated quickly within the early a part of the 12 months earlier than leveling off over the summer time. Current port strikes and lower-than-expected demand are elements within the latest downturn, which may have an effect on income for main waste corporations going into Q1.